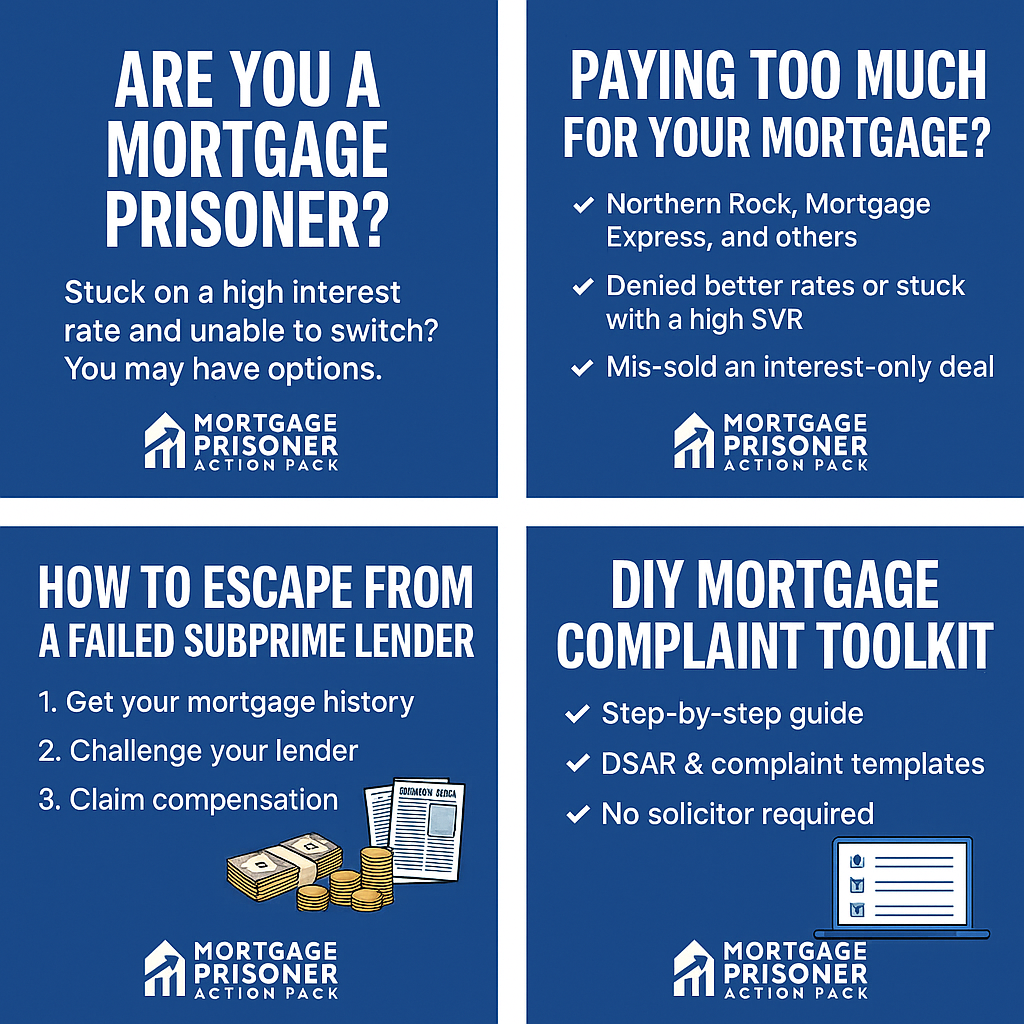

Take Back Control of Your Mortgage

Were you mis-sold a mortgage or charged hidden fees? You could be owed £1,000s.

Find out in minutes if you have a claim — no solicitor needed.

Use our tools to check for mis-selling, uncover secret commissions, and start your claim the right way.

- One-off payment — no hidden fees

- Complete claims pack — fully editable documents included

- Average claims range from £10,000 – £35,000+

Mortgage Control is an information and support service. This pack does not constitute legal advice and is not a substitute for regulated legal services. You will submit your complaint directly to your lender or the Financial Ombudsman Service free of charge.

Commonly Reported Lenders:

What Is the Mortgage Action Pack™?

The Mortgage Action Pack™ is a simple, step-by-step toolkit that helps you check whether your mortgage or secured loan was mis-sold — and shows you exactly how to claim compensation.

You don’t need any legal knowledge, and there’s no ongoing commitment. It’s a one-off download that puts everything in your hands.

Everything You Need — In One Pack

Editable Word documents (not PDFs)

Easy-to-follow instructions in plain English

Templates for every stage of the process

Designed for real people — not lawyers

Why?

Average claims are coming in at around £35,000, with some users identifying even more once they reviewed their paperwork. It only takes one missed commission or mis-sold product to trigger a serious refund.

How It Works — Just 4 Simple Steps

1.Enter Your Details

Click Start Now and enter your basic information — just your name, email, and lender details. Once complete, you’ll be taken straight to checkout to get instant access.

2.Get Instant Access

You’ll receive everything you need to take action yourself — including editable legal letter templates, lender contact info, and easy-to-follow guidance.

3. Identify Signs of Mis-Selling

Use the pack to request your paperwork, review your mortgage for signs of mis-selling or hidden commissions, and follow the step-by-step guide to prepare your complaint.

3.Claim Back What You’re Owed

Submit your complaint directly to the lender. If they reject or delay, the pack includes everything you need to escalate to the Financial Ombudsman Servic

What People Say

Tens of thousands of people in the UK have already reclaimed money due to mis-sold mortgages — often without even realising they had a case. Using the Mortgage Action Pack™

Sarah - Northern Rock

"£48.88 well spent. I feel in control now. I wouldn’t have spotted what the team at Mortgage Control found — but they reviewed everything, explained it all clearly, and now we’ve just sent our claim. Thank you!"

James – Kensington

"£28 well spent. I honestly didn’t expect to find anything. The pack made it simple — step-by-step, with all the templates ready. I sent my complaint yesterday. Fingers crossed, but I already feel like I’ve taken control."

FAQ

What exactly is the Mortgage Action Pack™?

It’s a downloadable set of documents and templates designed to help you investigate and potentially claim back unfair mortgage charges or hidden commissions — all without needing a solicitor. The pack includes complaint templates, DSAR requests, checklists, guidance, and escalation steps.

Does this pack guarantee I’ll get compensation?

No. We cannot guarantee a successful outcome. The pack is designed to help you raise a formal complaint or escalate your issue if you believe you were mis-sold a mortgage or were charged hidden fees, but each case depends on the evidence and how the lender responds.

Is this regulated legal advice?

No. The pack provides general guidance and templates to help you take action independently. It does not constitute legal advice. If you’re unsure or need legal representation, you should seek help from a qualified solicitor.

Do I need to have a current mortgage to use this pack?

No. Many successful claims are based on historic mortgages or loans, even if they’ve already been paid off. What matters is the lender, the broker (if used), and the terms of the agreement.

Which lenders or loans does the pack cover?

The pack is designed for use with a wide range of lenders — including Northern Rock, Kensington, GMAC, SPML, Swift, GE Money, and many others. It’s particularly useful where a broker was involved, and commissions or fees may not have been disclosed.

How much could a claim be worth?

Compensation varies widely. Some people claim a few hundred pounds, while others have received over £10,000. Most commonly, successful complaints lead to refunds of £1,000–£10,000+, depending on the loan amount and hidden charges.

Is this compliant with the FCA and FOS?

Yes. All templates and guidance are written in line with the Financial Conduct Authority’s (FCA) rules and the Financial Ombudsman Service (FOS) complaint handling process. However, we’re not regulated to give personal advice — this is a claims toolkit.

What if I need help reviewing my documents?

You are free to review your documents yourself using the guides provided. If you prefer, you can request additional support from our team or a qualified professional — but the pack is designed to make the process manageable without paying legal fees.